Turkey has started to meet its electricity need from Natural

Gas starting from 1985 at a growing rate, and as of 2011 installed capacity

ratio of Natural Gas fired plants to total is 48.47%, while ratio of

electricity supplied from these plants to total amounts to 45.36%. With these

high ratios, analyzing energy intensity rate of these power plants would make

sense in order to get a sip of sustainable development projections in Turkey.

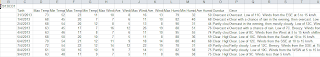

With regard to these graphs, important data that we will

focus on later is as follows;

Year

|

∆ Installed Capacity

|

∆ Production

|

2005

|

7.66%

|

7.47%

|

2006

|

6.46%

|

8.86%

|

2007

|

-0.87%

|

8.65%

|

2008

|

-4.86%

|

3.58%

|

2009

|

6.49%

|

-1.82%

|

2010

|

11.37%

|

8.42%

|

2011

|

0.62%

|

8.61%

|

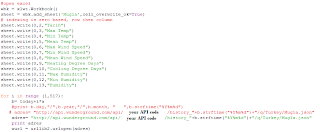

At this point, focusing on energy intensities of these power

plants on resource base, which is natural gas, will let us contemplate how

efficiently these plants are functioning. When we analyze natural gas use in

cubic meters in electricity sector with regard to total electricity produced in

GWh from natural gas, resource based energy intensity ratio will look as in the

following graph;

Data Source: Energy Balance Tables, ETKB (Ministry of Energy and Natural Resources), www.enerji.gov.tr

By using average energy intensity ratio, one can easily

calculate how much natural gas will be used by one power plant on average as

long as projected production is given for that plan in a year. Yet, while such

an intensity ratio makes sense investment and financial wise for a corporation,

tying this resource based energy intensity to Economic agenda is the crucial

one. That is to say, when we can adapt such an intensity measure to GDP

development and further to GDP per capita in Turkey, we will be able to

recommend policies in energy sector to maintain sustainable development. In

that sense, what we do here is to compare these figures with economic data,

mainly GDP per capita with current USD. The following graph shows the

relationship between the two:

What is striking here is that the correlation of resource

based energy intensity with regard to GDP (Current USD) per Capita goes on a

line from 2005 to 2011, except years 2009 and 2010! What makes these two

outlier years is that there had been economic contraction in 2009 with a ratio

of -4.83%. That is why, contemplating -4.83% GDP decrease for the former one

and 9.16% increase for the latter one, crisis year 2009 and post-crisis year

2010 have been outliers. Once we eliminate these crisis-related years from the

analysis, the picture becomes obvious; as the welfare increases for the

citizens in terms of GDP per Capita, energy intensity for Natural Gas fired

plants increase on a straight line. That should attract those who deal with

economic agenda since more of natural resource will be consumed to maintain

sustainable development.

Now it is time to conclude these data analyses and bring up

some policy recommendations:

- During a crisis year, energy intensity of NG fired plants increases, which means efficiency of the plants is lowered. In that sense, although crisis cannot be eliminated and thus inefficiency for plants, one can at least closely monitor post-crisis period when there can happen a boom in order to curb energy intensity for some efficiency gains.

- When we look at the data that show the change in both Installed capacity and Electricity produced, this is the conclusion;

o

When ∆ Production < ∆ Installed Capacity,

energy intensity increases and thus efficiency decreases – 2009 & 2010

cases

o

When ∆ Installed Capacity < ∆ Production,

energy intensity decreases and thus efficiency increases – 2005, 2006, 2007,

2008 & 2011 cases

Simply said:

Therefore, authorities should make sure that electricity production by NG fired plants is tied to investment in capacity so as to gain efficiency.

∆

P > ∆ IC

|

∆

P < ∆ IC

|

|

Energy

Intensity

|

↓

|

↑

|

Therefore, authorities should make sure that electricity production by NG fired plants is tied to investment in capacity so as to gain efficiency.

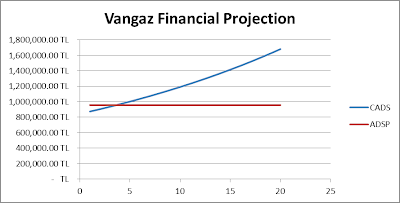

- In order to maintain sustainable development, innovation and efficiency for these power plants are of utmost importance in such a country with resource constraints as Turkey, which is energy dependent one. Therefore, policy tools to encourage efficiency in these plants as economic development takes place will curb energy intensity and thus current deficit, and will pave the way for economic welfare without monetary stress for these resources. To further understand this issue, the following illustration will better explain it graphically:

After year 2011, we assume that 16,000

USD/Capita welfare standard will be achieved in another 6-7 years. In business

as usual scenario, correlation of energy intensity and GDP/capita will walk on

the straight line and more energy will be needed to achieve higher standard of

welfare. At the end, on welfare point 16,000 USD/Capita, around 0.000226

Billion m3 of Natural Gas should be consumed to produce 1 GWh of Energy under

base scenario. However, when incentive programs are applied in two successive

periods to improve efficiency, around 0.000223 Billion m3 of Natural Gas should

be consumed to produce 1 GWh of Energy. Thus, less of total energy will be

consumed in successive years.